This global IPPN market study includes revenues from residential IP proxy networks, data center IP proxy networks, and mobile IP proxy networks. Use cases include: price comparison, ad verification, data collection, fraud protection, application performance, brand protection, talent sourcing, cyber security, and account management.

Disclaimer: This Market Report Published on https://luminati.io/static/IPPN-analysis-2019.pdf, Because this PDF has been fully public for several years, we thought it wouldn't hurt anyone to reprint it, if there is any copyright problem please Contact Us or email to [email protected].

Executive Summary

Key Findings

- Websites increasingly change their displayed information based on user IP address, location, and demographic attributes. This creates a need for companies to do competitor analysis, price comparisons, and data extraction as a simulated user to capture this customized information. Companies not familiar with these website practices or Internet Protocol proxy network (IPPN) solutions are at risk of gathering incorrect data and left behind technology-wise.

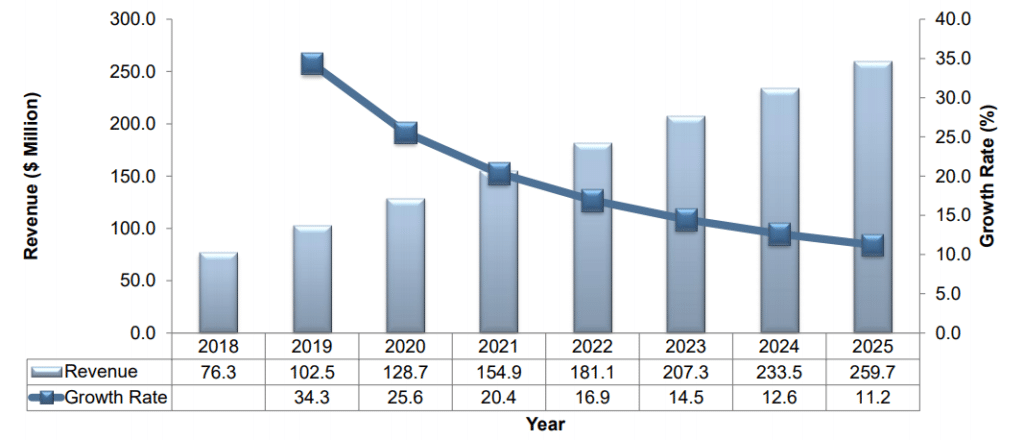

- Frost & Sullivan estimates the Total Addressable Market (TAM) for IPPNs in 2018 to be $951.0 million, the Service Available Market (SAM) to be $358.9 million, and the Service Obtainable Market (SOM) to be $76.3 million. $76.3 million is the combined revenue from market participants in 2018. This IPPN market is forecasted to grow at a CAGR of 16.8% and reach $259.7 million by 2025.

- This global IPPN market study includes revenues from residential IP proxy networks, datacenter IP proxy networks, and mobile IP proxy networks. Use cases include: price comparison, ad verification, data collection, fraud protection, application performance, brand protection, talent sourcing, cyber security, and account management.

- EMEA makes up 39.5% of revenues for the IPPN market in 2018, followed by NALA at 35.4%, and APAC at 27.7%. By 2025, NALA‟s 37.9% market share overtakes EMEA‟s 34.4% of IPPN market. Thanks to demographic trends and an increasing number of its residents developing online presences, APAC has fastest overall CAGR at 18.7% growing to a 27.7% market share by 2025.

- Market leader Luminati, which practically invented the category, and competitors Oxylabs and GeoSurf, make up 77.0% of the global IPPN market in 2018 with significant potential to grow as IPPN solutions become more well-known.

IPPN TAM, SAM, and SOM

Key Takeaway: With a 2018 SOM of $76.3 M obtained by the Frost & Sullivan forecasting method, coupled with a SAM of $358.9 M and a TAM of $951.0 M, the IPPN market is still in its early phases with tremendous potential for growth as more enterprises become aware of its advantages.

Total IPPN Market: TAM, SAM, and SOM, Global, 2018

Number of companies, globally, applicable to market use cases multiplied by average selling price (ASP).- IPPN Service Available Market (SAM)

In-House IPPN Use based on data center IP address allocation combined with revenue from dedicated solution providers. - IPPN Service Obtainable Market (SOM)

Revenue from dedicated IPPN solution providers, such as Luminati, Oxylabs, and GeoSurf.

Market Engineering Measurements

Total IPPN Market: Market Engineering Measurements, Global, 2018

IPPN Market Opportunity

Key Takeaway: Though Frost & Sullivan forecasts a market size of $259.7 M by 2025, there is an opportunity to convert existing home grown IPPN solutions. Assuming IPPN vendors convert 80% of home grown IPPN solutions by 2025 via accelerated marketing and consumer education, that increases the expected market to $341.7 M. This achieves a third of the Total Addressable Market in the first 10 years of IPPN existence.

Total IPPN Market: Revenue Opportunity, Global, 2018–2025 CAGR, 2019–2025 = 16.8% (SOM) / 20.1% (SAM)

CEO’s Perspective

Market Overview

Market Definitions

-

- Frost & Sullivan defines Internet Protocol (IP) proxy network (IPPN) providers as companies that offer products that place an extra IP address from a rotating pool of addresses between a customer and any website they visit on the public internet. Instead of getting data directly from a website, an IPPN customer‟s request first passes through a separate device, a proxy server, before going to and receiving a response from the target website

- From the target website‟s perspective, no information about the original machine is sent. Only the proxy device‟s IP address gets transmitted. As many websites place limits on the amount of information sent to any one IP address, gathering additional, openly available data from any one website often involves using proxy servers to make it appear as if the requests come from different users, thus requiring the need to a rotating pool of IP addresses to be used by proxy servers.

- The rotating pool of IP addresses derive from proxy software installed on residential users computers and mobile devices, while data centers use dedicated proxy servers. Based on the IP address it receives, a target website can distinguish whether a request comes from a residence, mobile device, or data center and display different information accordingly based on location and demographic attributes. Companies tailoring information based on such attributes led to competitors needing IPPNs to simulate being actual customers.

- Proxy servers are intermediaries between devices requesting information from other servers. While proxy servers have many purposes, such as anonymizing identities, filtering information, getting around filters, and improving information retrieval performance. Rotating IP proxy servers tend to be used by companies to simulate actual customers in different locations and to collect data, also known as web scraping. Ever since the commercialization of the web, companies developed increasingly better ways to target consumers via advertising and marketing to the point of adjusting pricing on a location or even per customer basis.

- As companies put more of their product information online, this customer targeting made it very difficult for competitors and customers to monitor and/or compare pricing and product availability that can vary so much because of targeting. Websites today recognize customers to show different advertising, content, and pricing based on location and other identifiable information. Companies further evolved to prevent competitors from accessing their data via blocking their company‟s entire range of IP addresses. This prevents companies from comparing pricing, security companies from conducing audits for or detecting malware on malicious sites, and even website owners themselves from verifying their advertising is safe and being delivered properly from their ad vendors.

- Practically all IP proxy network solution providers highlight their network size by publishing the node counts for residential/mobile/data center networks and the number of geographic regions served. IP proxy networks depend on users to install software on their devices, computers or handsets, to become the nodes used in IP proxy networks. This software, often games, uses idle bandwidth and computation resources in exchange for a better use experience, such as removing advertising.

- It is highly improbable that for any given market participant that all possible devices with IP proxy network software are on, idle, and online at any given time to provide bandwidth or computation time, so published network sizes are maximum possible values, not generally available values, i.e. devices on, idle, and online over a 24 hour period. At any one given time, 5% to 10% of devices are available on any given peer-to-peer based IP proxy network. The more static IPs on idle devices, such as PCs not being used, the higher the available devices versus mobile devices, which are generally less idle.

- To determine a metric more applicable to potential customers, i,e, generally available IP proxy network sizes, Frost & Sullivan ran scripts to count available IP addresses for different market

participants over different 24 hour periods. For each participant we noted: 1) published maximum IP proxy network size; and 2) generally available IP proxy network size. The actual network size will vary constantly based on devices being on, idle, and online on each network. - The Total Available Market (TAM) for IPPNs is the sum spent by enterprises on all use cases: account management, ad verification, application performance, brand protection, cyber security, data collection, fraud protection, price comparison, and talent sourcing. Many of these enterprises are unaware that IPPN solutions exist and would be entirely new customers.

- The Serviceable Available Market (SAM) for IPPNs is the sum spent by enterprises aware of proxies and currently programming their own proxy solutions in-house, primarily using data center IP addresses or using 3rd party solutions. Many of these enterprises are unaware of IP proxies using mobile or residential IP addresses and would be converts from in-house to 3rd party solutions.

- The Serviceable Obtainable Market (SOM) for IPPNs is sum spent by enterprises on existing 3rd party IPPN solutions, including residential, mobile, and data center IP proxy networks. This SOM portion of the market is what IPPN market participants Luminati, Oxylabs, GeoSurf, Scrapinghub (Crawlera), LimeProxies, Smartproxy, Storm Proxies, NetNut, and Microleaves among others, sell to enterprise users.

Market Overview – Scope and Regions

| Geographic coverage | Global |

| Study period | 2017–2024 |

| Base year | 2018 |

| Forecast period | 2019–2024 |

| Monetary unit | US Dollars |

| Conversion rates | €1.00 = $1.20 |

Revenue: Market size is in terms of vendor revenue in US dollars. Only product revenue accrued directly by the vendor is considered, including any built-in revenue for proxy operations maintenance. Reporting and estimates are for calendar years, not fiscal years.

Regional segmentation is as follows:

• North America and Latin America (NALA): Covering the continents of North America and South America, also referred to as Latin America.

• Europe, Middle East, and Africa (EMEA): Covering Western Europe, Central and Eastern Europe (including Russia), the Middle East, and Africa. India is not included in this region, although several vendors consider India within their EMEA business division.

• Asia-Pacific (APAC): Covering the Asian continent and Southeast Asian nations, including Australia and New Zealand.

IPPN Use Cases

Unlike static pages served in the early days of the web, modern websites are able to recognize viewers and display content, advertising, and pricing according to demographic and geographic

information. Websites are also able to block ranges of IP addresses to prevent competitors from comparing prices or conducting security audits and advertising checks. For these reasons, IP proxy networks are used for the following use cases, information publicly available to average consumers:

- Price comparison – comparing prices from different user perspectives, often for travel and niche products.

- Ad verification – ensuring website ads are properly targeted to their intended audience, that ad links function properly, and that the ad environment is security and/or regulatory compliant.

- Data collection – gathering data from websites to generate new data sets for internal use or sale.

- Fraud protection – identifying and/or detecting known proxies to prevent nefarious proxy use against companies.

- Application performance – testing web application loading and responsiveness across regions.

- Brand protection – preventing IP theft by disguising corporate networks when doing competitive analysis.

- Talent sourcing – researching job market needs and staffing requirements.

- Cyber security – adding an extra layer of protection between the Internet and corporate networks.

- Account management – creating and modifying accounts across social media and account-based websites.

These use cases can distributed among residential, mobile, and data center proxy networks, depending on the techniques used by the target website to block visitors.

Key Questions This Study Will Answer

Drivers and Restraints – Total IPPN Market

Market Drivers

Total IPPN Market: Key Market Drivers, Global, 2018–2024

| Drivers | 1–2 Years | 3–4 Years | 5–6 Years |

| Companies doing competitive analysis need to view websites as customers from different regions due to increased profiling and blocking from target websites. | H | H | H |

| Gathering data programmatically from websites, such as email addresses, real estate listings, and sports information, for analysis or for sale. | M | M | M |

| Growing concern over nefarious advertising practices and fraud detection lead to greater need for ad verification. | M | M | M |

| Increasing awareness of IPPN use cases will grow the total market as potential customers look for solutions for brand protection, cyber security, etc. at potentially lower cost than in-house solutions. | M | M | M |

| Social media account creation and maintenance need more automated tools as they provide increasingly desired direct communication between public figures, products, and events and their followers. | M | M | L |

| News of and competition from region-specific products, such as smartphones, and increasing globalization increase the need for location-based customer simulated competitive analysis. | M | M | L |

Impact ratings: H = High, M = Medium, L = Low

Drivers Explained

Companies doing competitive analysis need to view websites as customers from different regions due to increased profiling and blocking from target websites.

• The primary motivation for IP proxy networks is companies needing to see competitor websites as a typical customer sees them. Companies target consumers via advertising

and marketing to the point of adjusting pricing on a location or even per customer basis. This customer targeting makes it difficult for competitors to monitor and/or compare pricing and product availability without using IPPNs. Companies also increasingly block access to their websites from known ranges of their competitor IP addresses, making it difficult to do online competitive analysis without some form of proxy server.

Gathering data programmatically from websites, such as email addresses, real estate listings, and sports information, for analysis or for sale.

• The proliferation of available data on the Internet has led to automated gathering of information from websites, often called web scraping, indexing, crawling, or spidering. These automated scripts, or “bots,” generate just over 40% of Internet traffic in 2018 according to Distil Networks and this percentage is growing. Such scripts can be used to build new databases for analysis or to create new information services for sale. This type of automated data collection is how much of the Internet functions, from indexing websites for search engines to generating lists of available movie times to gathering weather forecast data.

Growing concern over nefarious advertising practices and fraud detection lead to greater need for ad verification.

• The billions of dollars generated by Internet marketing coupled with the automated nature of digital advertising leads to significant potential for advertising fraud. Malware infected browsers can give the false impression of web traffic and divert advertisements from ad servers. Plus, such mis-targeted advertising can cause brand harm if ads are not consistent with a company‟s message or values. By simulating residential or mobile IP addresses, IPPNs enable companies to see how advertisements appear to actual customers in different regions, verifying the appropriate, brand-confirmed ads, ads are being displayed.

Social media account creation and maintenance need more automated tools as they provide increasingly desired direct communication between public figures, products, and events and their followers.

• The increasing use of social media for person, product, and/or event promotion demands more tools to automate account management (creation and maintenance) in all the regions they are needed. This allows companies to maintain a global presence from centralized locations. Note: there is potential to use IPPNs to create artificial social media accounts, but IPPN vendors with strong know-your-customer guidelines and strict logging procedures limit this tactic.

News of and competition from region-specific products, such as smartphones, and growing globalization, increase the need for location-based customer simulated competitive analysis.

• Companies previously only had to deal with products in their home markets, however increasing global product news and awareness require companies perform competitive analysis across multiple regions. Better customer profiling and more customized manufacturing has lead to more targeted products being marketed to consumers. Discussion of such products across social media and online forums creates greater demand for companies to track all these niche products.

Increasing awareness of IPPN use cases will grow the total market as potential customers look for solutions for brand protection, cyber security, etc. at potentially lower cost than in-house solutions.

• Nascent markets grow as public awareness grows via advertising, news, social media, word of mouth, etc. As the IPPN market is only a few years old, smaller use cases will gradually expand the market as more customers share their stories, publish case studies, and demonstrate the usefulness to other customers. Though many customers choose to remain anonymous, sharing the process of how each use case improved their business helps grow the market. IPPN vendor marketing, technical support, and potentially lower costs also encourages companies to migrate in-house IPPN tools to dedicated IPPN solutions or start with dedicated tools in the first place.

Market Restraints

Total IPPN Market: Key Market Restraints, Global, 2018–2024

| Restraints | 1–2 Years | 3–4 Years | 5–6 Years |

| User concerns over installing any software that uses idle bandwidth and computing resources limit residential IP network growth, despite user experience improvements. | H | M | M |

| Price comparison sites and product shopping tools limit smaller IPPN use cases, while enterprises who want to control their technology develop home grown IPPNs. | H | H | L |

| Companies use artificial intelligence and/or machine learning to detect and block IP proxy network software. | M | M | M |

| Spurred by data breaches, privacy concerns, and social media regulations, countries enacted laws to limit companies posing as customers via IPPNs. | M | M | L |

| Difficulty in differentiating IPPN vendors and separating fact from fiction in reviews and online discussions, plus pending legal battles concern potential customers. | M | M | L |

| Limited awareness of IPPN use cases hinders overall market growth. | M | L | L |

Impact ratings: H = High, M = Medium, L = Low

Restraints Explained

User concerns over installing any software from less well-known sources or that uses idle bandwidth and computing resources, despite improving user experience.

• Consumers increasingly receive news of data breaches and privacy mishandlings leading to caution over installing any software from less well-known sources. By using software development kits (SDKs), IPPNs allow potentially any application to supply bandwidth and computation time in exchange for a better user experience, such as removing advertising. While consumers generally opt-in to using applications with IPPN SDKs and use the software more, installing less software overall diminishes the available pool of IP addresses gained by these installations, potentially making IPPNs less effective over time.

Price comparison sites and product shopping tools limit smaller IPPN use cases, while enterprises who want to control their technology develop home grown IPPNs.

• Dedicated price comparison tools can be sufficient for smaller businesses and product shopping tools like specialized shoe shopping apps limit the need for some niche price comparisons. While these tools also use IPPNs, they limit sales to potential customers who might otherwise purchase dedicated IPPNs services. Though most companies prefer IPPN vendor expertise, some business wanting to control their information flow can deploy their own proxy networks to avoid using 3rd parties. Not all companies require millions of rotating IP addresses, just enough IP addresses to accomplish their competitive analysis tasks.

Companies use artificial intelligence and/or machine learning to detect and block IP proxy network software.

• Much like the “cat and mouse” process of better user targeting that generated the need for IPPNs, companies have a vested interest in preventing competitive analysis to maintain their perceived advantages. Between artificial intelligence techniques and/or machine learning, companies are researching ways to detect and prevent IPPN usage, with or without regulations being put in place to identify web traffic routed through them. Even without known proxy IP lists, similar to known virtual private network IP lists, companies are investigating ways of blocking IPPNs, which diminishes their usefulness.

Spurred by data breaches, privacy concerns, and social media regulations, countries enacted laws to limit companies posing as customers via IPPNs.

• While it is nearly impossible to ban or block the exit nodes of IP proxy networks, governments could ban the practice of using IPPNs for intended use cases, similar to how Russia ordered virtual private networks (VPNs) to block access to sites in its centralized database, the European Union enacted privacy laws, or how Facebook is requesting social media regulation. As legitimate IPPNs keep log files, there is less incentive to use them for nefarious purposes, and those IPPNs using strict know your customer (KYC) practices can minimize unintended use and help prevent the need for such regulations.

Difficulty in differentiating IPPN vendors and separating fact from fiction in reviews and online discussions, plus pending legal battles concern potential customers.

• Researching the IPPN market for a preferred vendor yields an assortment of reviews, comparisons, blog posts, online discussions, and news, not all of which are from wellknown sources or verifiable journalists. Each vendor claims thousands to millions of rotating IP addresses, assorted price points, and available locations. Until the market matures with greater coverage by computer industry publications, potential customers find it difficult to choose between vendors. Larger vendors with extensive education materials and documentation help offset this situation. Pending legal battles protecting intellectual property are important to IPPN market development and may influence some customers toward particular vendors.

Limited awareness of IPPN use cases hinders overall market growth.

• While many companies understand the problem of doing competitive analysis, data collection, and other IPPN use cases, widespread awareness of IPPNs is still lacking. Proxy networks are well understood and virtual private networks are gaining in popularity, but IPPNs are still in the early adopter phase among companies who stand to benefit from them. This restraint accounts for not all IPPN vendors having the marketing budgets to promote themselves, through the total market should be helped by larger vendor advertising. This restraint counterbalances the increasing awareness driver.

Forecasts and Trends – Total IPPN Market

Forecast Assumptions

This study derives the size of the global IPPN market bottom-up from vendor revenues, including any built-in revenue for proxy operations maintenance. Projections consider weighted averages of the impacts of drivers and restraints detailed in the previous section and assume that they will remain as forecast. The following factors impact forecast numbers:

- Currency: This research service reports market size in US dollars. Actual market revenue will vary with the relative value of the US dollar.

- Economy: Forecasts assume a stable, slowly expanding global economy.

- Consumer confidence: Forecasts assume consumer confidence will remain relatively stable.

- Disruptive innovation: Forecasts assume gradual, incremental improvements across vendors. Any IPPN vendor introducing a disruptive innovation could trigger unforeseen changes in sales, revenues, and market shares.

- Exclusions: These numbers do not include revenue from home-grown IP proxy network solutions.

Global IPPN Revenue Forecast

Key Takeaway: Global revenue growth rate increases as companies target consumers more accurately and attempt to prevent competitors from accessing their information as consumers. Growing awareness of the IPPN market encourages companies to migrate from in-house solutions.

Total RPN Market: Revenue Forecast, Global, 2018–2025 CAGR, 2019–2025 = 16.8%

Global Revenue Forecast Discussion

- The global IPPN market grossed $76.3 million in 2018. Frost & Sullivan expects it to grow at a CAGR of 16.8% to $259.7 million by 2025.

- The market is led by NALA in the base year, followed closely by EMEA, which will be surpassed by APAC by the end of the forecast. The expected large-scale infrastructure spending will make APAC the fastest-growing region. Regional growth rates and nuances are discussed in the following sections.

- Market growth can also be attributed to the rising uptake of ad verification, brand protection, price comparison, fraud protection, data collection, cyber security, and application performance needs globally.

- About 70% of the market revenue is expected to come from recurring business and 30% from new customers.

- The flexibility offered by residential and mobile IPPNs versus data center IPPNs is an important growth driver. Companies needing both use cases are increasing, and cloud-based solutions enable easy stakeholder collaboration and faster project turnaround.

Regional Technology Adoption Cycle

Total IPPN Market: Regional Technology Adoption Cycle, Global, 2018

Percent Revenue Forecast by Region

Key Takeaway: In 2018, the EMEA region had the largest revenue share, followed closely by NALA. By 2025, NALA and APAC will increase their market shares at the expense of EMEA.

Total RPN Market: Percent Revenue Forecast by Region, Global, 2018 and 2025

IPPN Revenue Forecast by Region

Key Takeaway: In 2018, the EMEA region had the largest revenue share, followed closely by NALA. By 2025, NALA and APAC will increase their market shares at the expense of EMEA.

Total IPPN Market: Revenue Forecast by Region, Global, 2018–2025

| Year | NALA ($ Million) | EMEA ($ Million) | APAC ($ Million) |

| 2018 | 27 | 30.1 | 19.1 |

| 2019 | 36.8 | 39.9 | 25.7 |

| 2020 | 46.9 | 49.4 | 32.5 |

| 2021 | 57.2 | 58.4 | 39.3 |

| 2022 | 67.5 | 67 | 46.5 |

| 2023 | 77.9 | 75.1 | 54.3 |

| 2024 | 88.1 | 82.6 | 62.7 |

| 2025 | 98.3 | 89.4 | 72 |

| CAGR | 17.80% | 14.40% | 18.70% |

Regional Revenue Forecast Discussion

- The market for IPPN solutions grossed revenues of $27.0 million in NALA, $30.1 million in EMEA, and $19.1 million in APAC in 2018.

- The IPPN market in NALA is expected to grow at a CAGR of 17.8% to $98.3 million by 2025, going from a 35.4% revenue market share to 37.9%. Frost & Sullivan expects North America, particularly the United States, to undertake more IPPN projects over the forecast period.

- The IPPN market in EMEA is expected to grow at a CAGR of 14.4% to $89.4 million by 2025; while the region is still growing, its revenue share over 2018-2025 will decrease from 39.5% to 34.4% as NALA and APAC grow faster. Regional uncertainty over the consequences of Brexit hamper growth of major expenditures which spur the sales of IPPN solutions.

- The IPPN market in APAC is expected to grow at a CAGR of 18.7% to $72.0 million by 2025, increasing its revenue share from 25.1% to 27.7%. Expected IPPN spending will make APAC the fastest-growing region as demographic trends and higher economic growth rates along with more repressive Internet policies encourage additional spending.

Percent Revenue Forecast by Use Case

Key Takeaway: Price comparison and ad verification are the primary use cases for IPPNs along with data collection showing growth over the forecast, while other use cases remain flat or shrink.

Total RPN Market: Percent Revenue Forecast by Use Case, Global, 2018 and 2025

Forecasts and Trends – NALA

NALA Revenue Forecast

Key Takeaway: The NALA market will grow at a CAGR of 17.8% over the forecast period. Revenue will double over the forecast as customer realize the benefits of and adopt IPPNs.

RPN Market: Revenue Forecast, NALA, 2018–2025 Revenue CAGR, 2019–2025 = 17.8%

NALA Revenue Forecast Discussion

-

-

- At $27.0 million in 2018, revenue for the NALA market for IPPN solutions was just behind EMEA and well ahead of APAC. Frost & Sullivan expects NALA revenue to reach $98.3 million by 2025, at a CAGR of 17.8%.

- North America witnessed healthy growth over the past year thanks to increasing competitive analysis in the United States causing companies to further lock down their information from competitors. This growth is mostly due to the region‟s first mover advantage in IPPN adoption and the acceleration of use case trends leading to a proliferation of services.

- Brazil has traditionally led Latin America in terms of IPPN spending; however, poor economic conditions affected the region in 2018 and several vendors saw a decline in their revenue from Brazil.

- Additional IPPN services coming to market a far-reaching positive effect on the IPPN vendors in NALA. Competition has helped constrain the costs of some services, but the growing need from

enterprise customers is leading to more attention being placed on IPPN services. - Consolidation is inevitable in the IPPN market. These mergers and acquisitions have the potential to create a larger competitor to market leader Luminati, primarily by combining support organizations.

-

Forecasts and Trends – EMEA

EMEA Revenue Forecast

Key Takeaway: EMEA makes up over one third of the global IPPN market in 2018. Growth from Western Europe is countered by countries in the Middle East and Central and Eastern Europe.

RPN Market: Revenue Forecast, EMEA, 2018–2025 Revenue CAGR, 2019–2025 = 14.4%

EMEA Revenue Forecast Discussion

-

-

- EMEA contributed $30.1 million in sales, or 39.5% of the global market revenue in 2018, just ahead of NALA and well ahead of APAC.

- Many IPPN vendors grew out of Europe, and so have their strongest footprint in the EMEA region.

- Strong demand for IPPN solutions continues from the Middle East, driven by investment in Internet infrastructure. Since internet costs in the Middle East are among the highest in the world, the region‟s overall growth has been limited by these costs.

- EMEA is expected to show modest growth with a CAGR of 14.4%. Economic uncertainty in Europe; geopolitical instability in the Middle East, Russia, and parts of Africa; and the fact that spending on internet infrastructure projects is not expected to reach pre-recession levels until the end of the decade will only mean slow growth through 2025.

-

Forecasts and Trends – APAC

APAC Revenue Forecast

Key Takeaway: At a CAGR of 18.7%, APAC follows NALA as the fastest growing region for IPPN revenues over the forecast period.

RPN Market: Revenue Forecast, APAC, 2018–2025 Revenue CAGR, 2019–2025 = 18.7%

APAC Revenue Forecast Discussion

-

-

- At $19.1 million in 2018, APAC was the smallest regional market for IPPN solutions by revenue. Market revenue is expected to increase to $72.0 million by 2025 at a CAGR of 18.7%.

- Among all regions, APAC is the most price-sensitive market for technology solutions in general. The tendency for firms to build home grown solutions or employ system integrators to make customized solutions is the highest here, though regulations in most countries in the region drive demand more than other regions.

- As emerging economies continue to urbanize, build out infrastructure, and grow their industries, it will become imperative for companies in this region to follow global standards and best practices and to implement checks and balances, in order to gain confidence in the global market. Because IPPN solutions will be looked upon as a cost of doing business, price sensitivity is expected to wane.

- Some vendors consider Australia a growing market, although some have been affected by the downturn in the region‟s economy.

-

Market Share and Competitive Analysis – Verticals

IPPN Competitive Landscape – Vertical Market Share

Key Takeaway: The split between residential, mobile, and data center IPPN verticals is dominated by residential at over 73%, followed by data centers at almost 20%, with mobile at 7% in 2018. Choice of vertical depends on the techniques used by target websites to block visitors

Total IPPN Market: Vertical Analysis, Global, 2018

Verticals Discussion

-

-

- IP proxy networks enable companies to simulate being actual customers by having users around the world install software and agree to contribute a portion of their devices resources when idle to route web traffic through their IP address. This is known as a residential proxy network, one of the three verticals used in the market along with mobile and data center IPPNs.

- By getting thousands to millions of users to participate in their network, IP proxy network companies create a pool of IP addresses to accomplish the aforementioned use cases. Since each node on the network is in a different location using a different device, in the case of residential IPPNs websites only see traffic as coming from individuals and residential internet service providers (ISPs).

- IP proxy network companies can also provide IP addresses coming from data centers instead of ISPs. These data center proxies also hide IP addresses and location, and allow for data collection,

but they are known not to be residential or mobile. While they are generally less expensive than residential or mobile proxies, they do not offer the benefits of appearing as actual customers. - As more Internet use goes to mobile devices, IPPNs can also used to simulate traffic coming from handsets, however it is more difficult to regulate broadband usage via cellular and WiFi, plus idle computing time must be accounted for while on batteries versus charging.

-

Market Share and Competitive Analysis – Total IPPN Market

IPPN Competitive Landscape – Market Share

Key Takeaway: Luminati, Oxylabs, and GeoSurf dominated the global IPPN market in 2018, combining to represent 77.0% of the total market.

Total IPPN Market: Market Share Analysis, Global, 2018

IPPN Competitive Environment

Total IPPN Market: Competitive Structure, Global, 2018

| Number of Companies in the Market | 21+ |

| Competitive Factors | IP addresses, geographic coverage, locations served, pricing tiers, bandwidth provided, high compliance standards, and network (IP)quality. |

| Key End-user Groups | Price comparison, ad verification, data collection, fraud protection, application performance, brand protection, talent sourcing, cyber security, and account management. |

| Major Market Participants | Luminati, Oxylabs, GeoSurf |

| Market Share of Top 3 Competitors | 77.00% |

| Other Notable Market Participants | Scrapinghub, LimeProxies, Smartproxy, Storm Proxies, NetNut, Microleaves |

| Distribution Structure | Direct sales |

| Notable Acquisitions, Mergers, Deals | EMK Capital LLP acquired a majority share in Luminati in 2017. Luminati„s enterprise proxy solutions separated from Hola Networks in 2014. Begun in 2018, Luminati is suing Oxylabs and GeoSurf for patent infringement. |

Luminati At A Glance

| Company Name | Luminati |

| Location | Netanya, Israel |

| Owner | Private (120+ employees), EMK Capital LLP, United Kingdom |

| Platform | Luminati Proxy Service (Residential IPs, Mobile IPs, and Data Center IPs) |

| Product Revenue | $40 Million |

| Industries Served | Retail price comparison, ad verification, sales intelligence, brand protection, self-testing |

| Notable Customers | Fortune 500 companies across all verticals |

| Primary Competitors | Oxylabs, GeoSurf, Scrapinghub, LimeProxies, Smartproxy, Storm Proxies, NetNut, Microleaves |

| Platform Highlights | 35.0M+ published residential IPs / 35.0M+ generally available residential IPs Serves 195 countries, 26,846 cities, 11,748 ASNs, 592 Mobile ASNs. The only IP proxy network that requires consent from its residential peers and has strict KYC rules. Proxy Manager, Chrome Extension, APIs available in Shell, Node.js, Python, C#, Java, VB, PHP, Ruby, and Per |

Oxylabs At A Glance

| Company Name | Oxylabs |

| Location | Vilnius, Lithuania |

| Owner | Private (11-50 employees), Part of Tesonet |

| Platform | Residential IPs, Data Center IPs, Real-Time Crawler |

| Product Revenue | $10 Million |

| Industries Served | Market research, brand protection, travel fare aggregation, ad verification, pricing intelligence |

| Notable Customers | 700+ customers, Case studies change customer names to provide anonymity. |

| Primary Competitors | Luminati, GeoSurf, Scrapinghub, LimeProxies, Smartproxy, Storm Proxies, Microleaves, NetNut (Luminati sued Oxylabs in 2018 for patent infringement.) |

| Platform Highlights | 30.0M+ published residential IPs / 24.3M+ generally available residential IPs Serves 195 countries. Two apps using the embedded Oxylabs SDK, Material Notification Shade and Power Shade, were taken down from Google Play Store when the SDK was marked as malicious by Google. The apps were reinstated a day later without the Oxylabs SDK. |

GeoSurf At A Glance

| Company Name | GeoSurf |

| Location | Tel Aviv, Israel, Development in Romania and Ukraine. |

| Owner | Private (11-50 employees), part of BIScience |

| Platform | Residential IPs, Data Center IPs |

| Product Revenue | $8 Million |

| Industries Served | Ad verification, social listening, search engine optimization, sales intelligence, sneaker proxy |

| Notable Customers | 7,000+ Professional Marketers, Ubisoft |

| Primary Competitors | Luminati, Oxylabs, Scrapinghub, LimeProxies, Smartproxy, Storm Proxies, Microleaves, NetNut (Luminati sued GeoSurf in 2018 for patent infringement.) |

| Platform Highlights | 2.0M+ published residential IPs / 1.4M+ generally available residential IPs Serves 130+ global locations. Good blog and resources explanation for prospective customers. |

Scrapinghub At A Glance

| Company Name | Scrapinghub |

| Location | Ballincollig, Cork, Ireland |

| Owner | Private (51-200 employees) |

| Platform | Crawlera, “The World‟s Smartest Proxy Network” |

| Product Revenue | $4 Million |

| Industries Served | Focuses on data scraping, not individual use cases, like price comparison. |

| Notable Customers | 2000+ Companies as customers, Used by over 1M+ developers Data scraping customers: Amazon, Deloitte, HubSpot, Logitech, Walmart |

| Primary Competitors | Luminati, Oxylabs, GeoSurf, LimeProxies, Smartproxy, Storm Proxies, Microleaves, NetNut |

| Platform Highlights | No published residential IP network size Almost hides proxy network to focus on data scraping. Open Sources much of their code, giving clients peace of mind. APIs available in Python, Node.js, Scrapy, C#, Java, PHP, Ruby |

Smartproxy At A Glance

| Company Name | Smartproxy |

| Location | Unknown |

| Owner | Unknown |

| Platform | Oxylabs Reseller |

| Product Revenue | $3 Million |

| Industries Served | Account management, product releases, market research…also markets specific proxies for Instagram, Sneakers, Twitter, Craigslist, Facebook, Reddit, and for backconnects |

| Notable Customers | s Only lists anonymized residential customers, i.e. last name redacted. Any corporate customers kept anonymous. |

| Primary Competitors | Luminati, Oxylabs, GeoSurf, Scrapinghub, LimeProxies, Storm Proxies, Microleaves, NetNut |

| Platform Highlights | 10.0M+ published residential IPs / 7.4M+ generally available residential IPs 90%+ of available IP addresses appear to be resold Oxylabs nodes. Serves 190+ geographic locations. Very sneaker-focused and very use case-focus versus vertical-focus, e.g. Get Instagram proxies versus Get Social Media proxies. Blog has good use case explanations of how their Smartproxy solves improves that specific use case. |

LimeProxies At A Glance

| Company Name | LimeProxies |

| Location | Hong Kong |

| Owner | Private (11-50 employees) |

| Platform | High speed, premium proxies |

| Product Revenue | $1 million |

| Industries Served | Gaming proxies, ticketing proxies, Socks5 proxies, classified ads, custom solutions. |

| Notable Customers | Anonymous. No real case studies from current customers. |

| Primary Competitors | Luminati, Oxylabs, GeoSurf, Scrapinghub, Smartproxy, Storm Proxies, Microleaves, NetNut |

| Platform Highlights | No published residential IP network size Serves 40+ geographic locations, makes a point of not being a subsidiary or reseller of larger, parent company. Lot of bad chatter on forums about customer service and affiliate programs recommending against LimeProxies. |

Storm Proxies At A Glance

| Company Name | Storm Proxies |

| Location | Unknown |

| Owner | Unknown |

| Platform | Backconnect Rotating Proxies |

| Product Revenue | $2 Million |

| Industries Served | Web scraping, traffic bots, bulk account registrations, search engine optimization tools, ticket sites, sneaker sites |

| Notable Customers | Anonymous. No real case studies from current customers. |

| Primary Competitors | Luminati, Oxylabs, GeoSurf, Scrapinghub, LimeProxies, Smartproxy, Microleaves, NetNut |

| Platform Highlights | 40,000 published residential IPs / Proxies rotated every 5 minutes. Dedicated proxy verticals, much like Smartproxy, i.e. Ticketmaster, Instagram, Facebook, Twitter, Tumblr, Pinterest, Linkedin, Snapchat, Pokemon Go proxies |

NetNut At A Glance

| Company Name | NetNut |

| Location | Tel Aviv, Israel |

| Owner | Private, part of Safe-T Group Ltd. as of mid-2019 |

| Platform | NetNut SuperProxy |

| Product Revenue | $2 Million |

| Industries Served | Price comparisons, web scraping |

| Notable Customers | Anonymous. No real case studies from current customers. |

| Primary Competitors | Luminati, Oxylabs, GeoSurf, Scrapinghub, LimeProxies, Smartproxy, Storm Proxies, Microleaves |

| Platform Highlights | 10.0M+ published residential IPs / 7.4M+ generally available residential IPs Serves approximately 50 countries. NetNut uses ISP IPs directly. Traffic does not go through end-user devices. Instead of using a peer to peer (P2P) network, NetNut depends on DiViNetworks‟ existing data delivery and network management solutions. DiViNetworks provides services to over 100 ISPs from tens of point of presence (PoPs) around the world. Safe-T Group Ltd. acquired NetNut in mid-2019 to augment their software-defined access technology. |

Microleaves At A Glance

| Company Name | Microleaves |

| Location | London, UK |

| Owner | Unknown (19 employees) |

| Platform | Adware |

| Product Revenue | $1.3 Million |

| Industries Served | Web scraping, ticket sites, sneaker sites |

| Notable Customers | 19k Active Customers, 60+ New Customers Daily, Fortune 500 Companies |

| Primary Competitors | Luminati, Oxylabs, GeoSurf, Scrapinghub, LimeProxies, Smartproxy, Storm Proxies, NetNut |

| Platform Highlights | Microleaves proxy client software has been identified as an adware program by various malware and virus tools. While its stated use is as an IP proxy network, it appears to be serving unwanted advertisements across visited webpages. Though Microleaves claims to have the lowest fail rate, instant scaling, user-friendly integration, no limit on concurrent connections, 26M+ residential IPs, 5M+ mobile IPs, and 500K+ data center IPs, testing was not performed to determine generally available IPs because of security concerns over its proxy client software used to generate their network. |

IPPN Competitive Landscape

Key Takeaway: Luminati, Oxylabs, and GeoSurf dominated the global IPPN market in 2018.

Total IPPN Market: Competitive Landscape, Global, 2018

IPPN Competitive Landscape – Factors and Assessment

The IPPN competitive landscape represents the relative positioning of vendors in terms of their current market share and their strategic positioning for growth according to the following factors:

1. Current market share by percentage of revenue: The X axis represents a vendor‟s market position; the size of the company‟s circle represents its base year revenues.

2. Relative strategic excellence: The Y axis depicts a vendor‟s strategy score, particularly how likely it is to outperform the market and win market share from its nearest competitors. Factors include:

- Current functionality and ongoing R&D investment: Feature-rich IPPN solutions with a strong, consistent commitment to R&D score the highest on this vector.

- Scalability: The ability to manage large volumes of engineering assets and to work crossregionally and cross-functionally, on both mobile and cloud, determine the scalability score.

- Flexibility: Integrating or working alongside legacy solutions and other enterprise software.

- Vertical and geographic footprint: Working across industries and various countries.

- Merger and acquisition, partnership, and standardization strategy: Buying and/or partnering with other vendors, coupled with organic growth.

IPPN Competitive Landscape – Market Leader Luminati

- Luminati is the only proxy network that requires consent from its peer network, has tight compliance procedures for its customers, and serves Fortune 500 enterprises. With over 35 million residential IP addresses, Luminati provides rotating IP proxy access in 195 countries across 26,846 cities, 11,748 Autonomous System Numbers (ASNs), and 592 mobile ASNs.

- Luminati enables enterprise customers to access the internet and view websites as they look to actual consumers. As companies block and slow the web to competitors, Luminati‟s proprietary

network allows companies to access the web as if they were in any city covered by their residential IP network. - Luminati serves enterprise clients across many vertical industries to verify ad performance, collect data, such as pricing information, conduct cyber security checks, protect their brand, monitor application performance, and prevent fraud. Using a residential IP proxy service is the only way businesses can check the accuracy of data and pricing matching what customers see in various regions around the world.

Growth Opportunities and Companies to Action

Growth Opportunity 1: Expand Consumer Education

Growth Opportunity 2: Multi-Privacy Solutions

Growth Opportunity 3: Provide White Label IPPNs

Growth Opportunity 4: Mergers and Acquisitions

Strategic Imperatives for Success and Growth

The Last Word

The Last Word – Recommendations

Legal Disclaimer

Frost & Sullivan is not responsible for any incorrect information supplied to us by manufacturers or users. Quantitative market information is based primarily on interviews and therefore is subject to fluctuation. Frost & Sullivan research services are limited publications containing valuable market information provided to a select group of customers. Our customers acknowledge, when ordering or downloading, that Frost & Sullivan research services are for customers‟ internal use and not for general publication or disclosure to third parties. No part of this research service may be given, lent, resold or disclosed to noncustomers without written permission. Furthermore, no part may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the permission of the publisher.

For information regarding permission, write to:

Frost & Sullivan

3211 Scott Blvd, Suite 203

Santa Clara, CA 95054

© 2019 Frost & Sullivan. All rights reserved. This document contains highly confidential information and is the sole property of Frost & Sullivan.

Appendix

Market Engineering Methodology

One of Frost & Sullivan‟s core deliverables is its Market

Engineering studies.They are based on our proprietary Market

Engineering Methodology. This approach, developed across the

50 years of experience assessing global markets, applies engineering

rigor to the often nebulous art of market forecasting and interpretation.

A detailed description of the methodology can be found here.

Market Engineering Measurements

Total IPPN Market: Market Engineering Measurements, Global, 2018

Market Overview

| Measurement Name | Measurement | Trend |

| Market Stage | Growth | – |

| Market Revenue (2018) | $76.3 M | ▲ |

| Market Size for Last Year of Study Period (2025) | $259.7 M | ▲ |

| Base Year Market Growth Rate (2018) | 34.30% | ▼ |

| Compound Annual Growth Rate (CAGR, 2019 – 2025) | 16.80% | – |

| Customer Price Sensitivity (Scale:1 [low] to 10 [high]) | 8 | ● |

| Degree of Technical Change (Scale:1 [low] to 10 [high]) | 7 | ▲ |

| Market Concentration (Base Year Market Share Held by Top 3 Companies) | 77.00% | ▼ |

Decreasing Stable Increasing

▼ ● ▲

List of IPPN Market Participants

| Primary | Others |

| • Luminati | • RotatingProxies |

| • Oxylabs | • Local Proxies |

| • GeoSurf | • Smart DNS Proxy |

| • Scrapinghub (Crawlera) | • Residential IPs |

| • LimeProxies | • ProxyRain |

| • Smartproxy | • ProxyMesh |

| • Storm Proxies | • ProxyRack |

| • NetNut | • ProxyKey |

| • Microleaves | • Intoli |

| • BlazingProxies | |

| • ProxyRotator | |

| • GhostProxies | |

| • Xverum |

References: Unchanged:

Last Updated on May 15, 2022